In Real Life.

Proof of Concept

Content Strategy

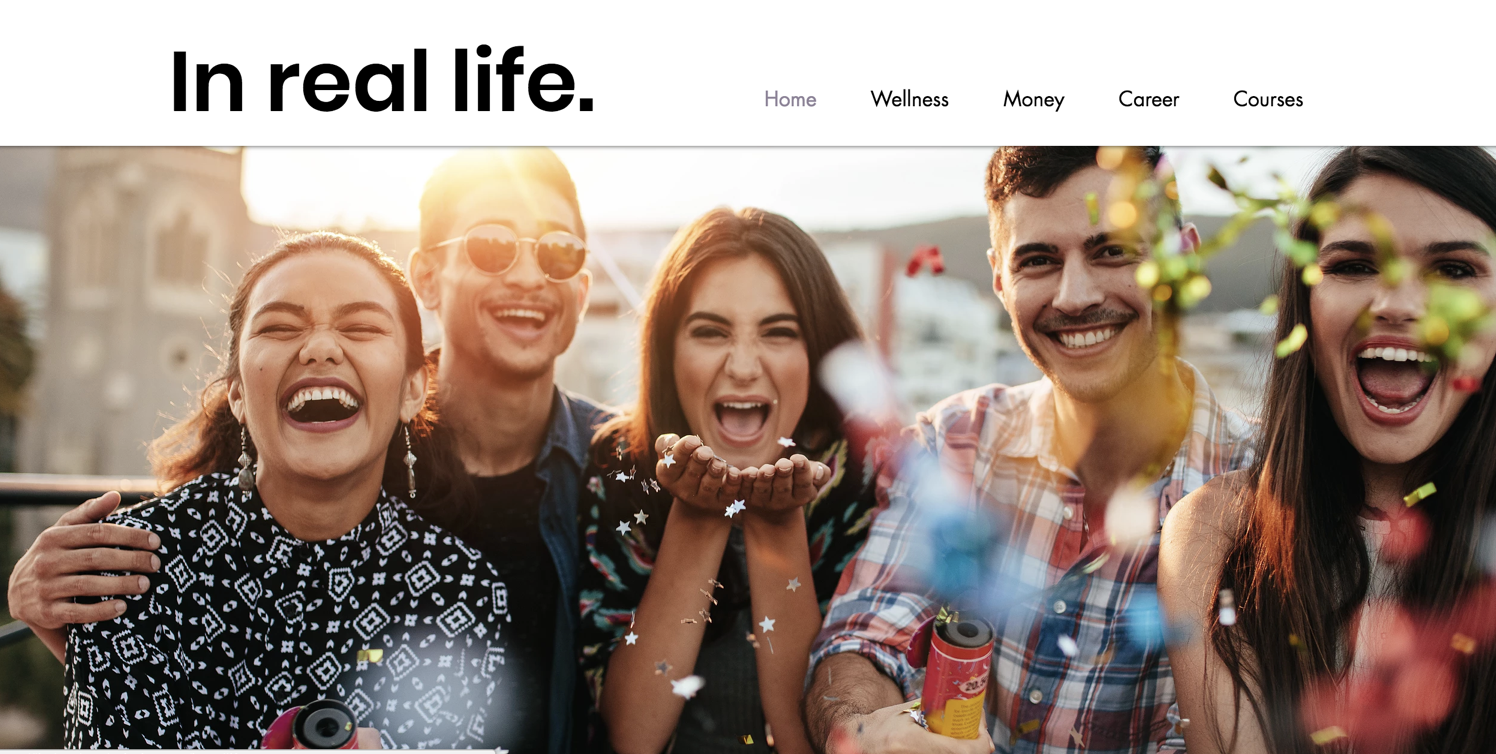

A lifestyle media brand dedicated to helping people live their best life mentally, physically, emotionally and financially, with mindfulness and connection to each other and to our communities.

The Challenge

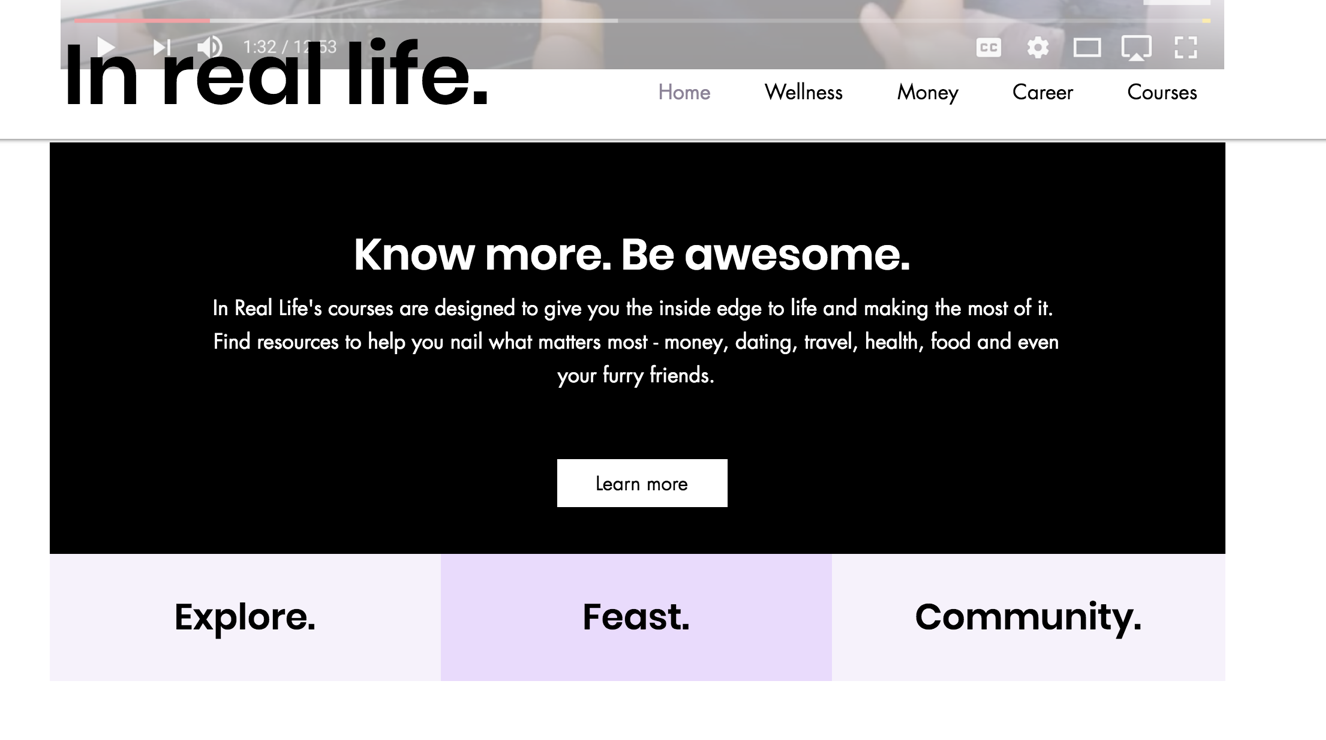

‘In real life’ is a content platform.

A lifestyle media brand dedicated to helping people live their best life mentally, physically, emotionally and financially, with mindfulness and connection to each other and to our communities.

An integrated way to engage Australians on their finances & wellbeing through lifestyle content.

Across digital & In real life.

Rationale

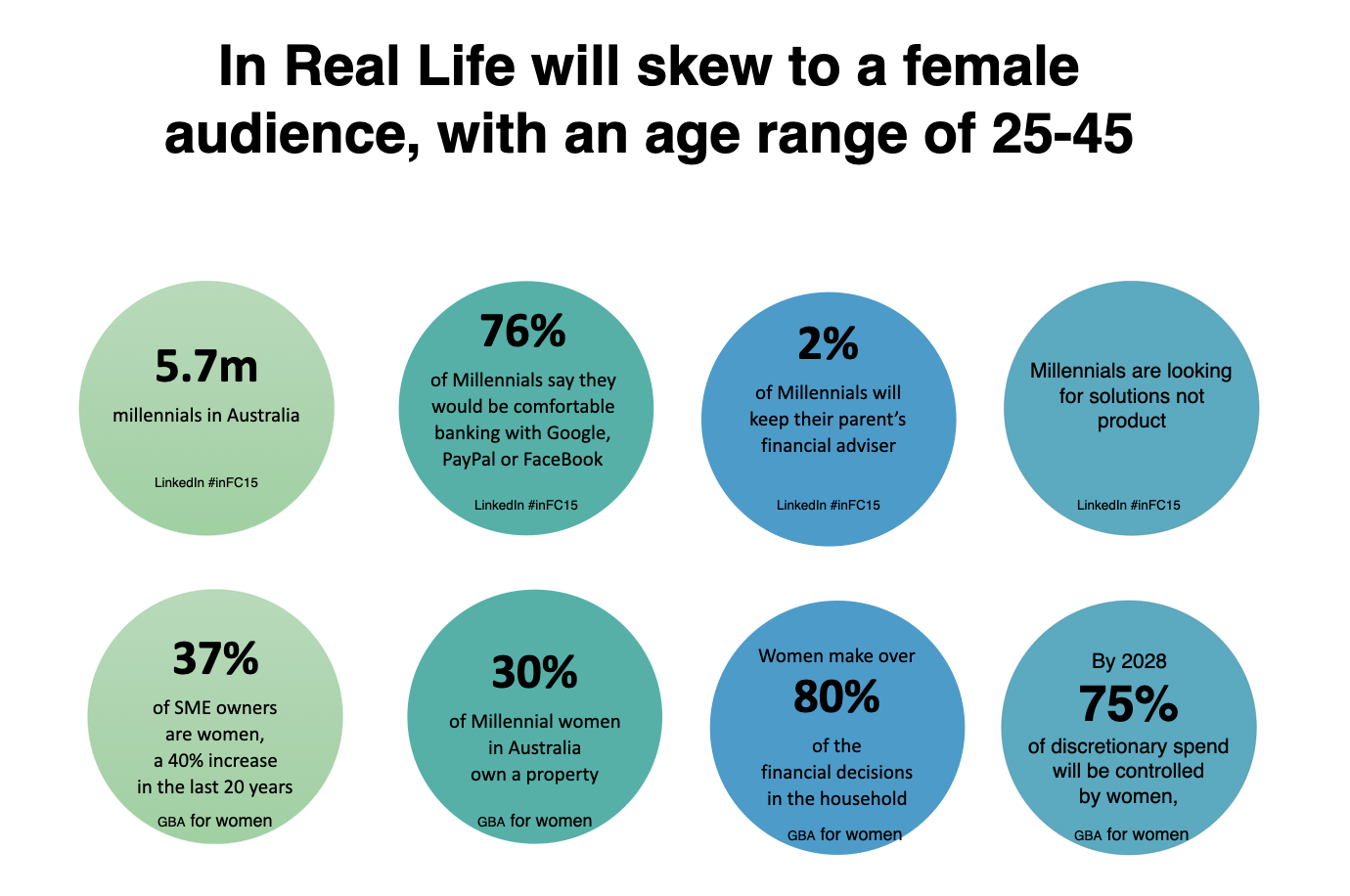

A vast number of young adults are facing an uncertain financial future. So, instead of making a case for something people don't want, so we set out to make a difference. Together we created a sort of ‘school of life’ program for adulthood, where the curriculum covers everything from investing in super, to having that hard talk about a budget, to introducing a fur kid into the fold. We called it ‘In real life’.

In Real Life aimed to be seen as the leading voice in the changing conversation and attitudes around finances and wellbeing for younger demographics, by helping them effectively navigate the complexities of life, as a trusted adviser.

I designed the concept from the ground up—designing a brand identity, a digital platform with some of the most sophisticated financial planning tools in the industry, with plans for a brick-and-mortar locale using coworking spaces. We thought everything through, and in the end, everything added up to a common vision. In Real Life is building on that vision, innovating and growing every day.

Why "In Real Life?" Because we're all here to help each other become a little smarter. And a little more grown-up. In real life.

’In real life’ was not simply a design solution, but the beginning of a solution to a much larger cultural problem. The name ‘In real lIfe’ raises eyebrows, which is part of why it resonated - it's provocative and plays on the vernacular - it's more than just a name, it's a mindset. And it has the potential to inspire a movement.

You either have a smart-money mindset or you don't—people don't learn to be better money managers gradually, over time. We realised that we couldn't expect our audience to rise to a level of financial sophistication on their own. Someone would have to help them. Why not us? It’s a huge population and they have become profoundly disengaged from financial services, and we needed to reconnect them in a way they could trust. It was a matter of designing for an unmet need—providing resources for many facets of adulting life, with personal finance at the core—and that wasn't about any single solution, but an entire system of tools, services, and creative tactics.